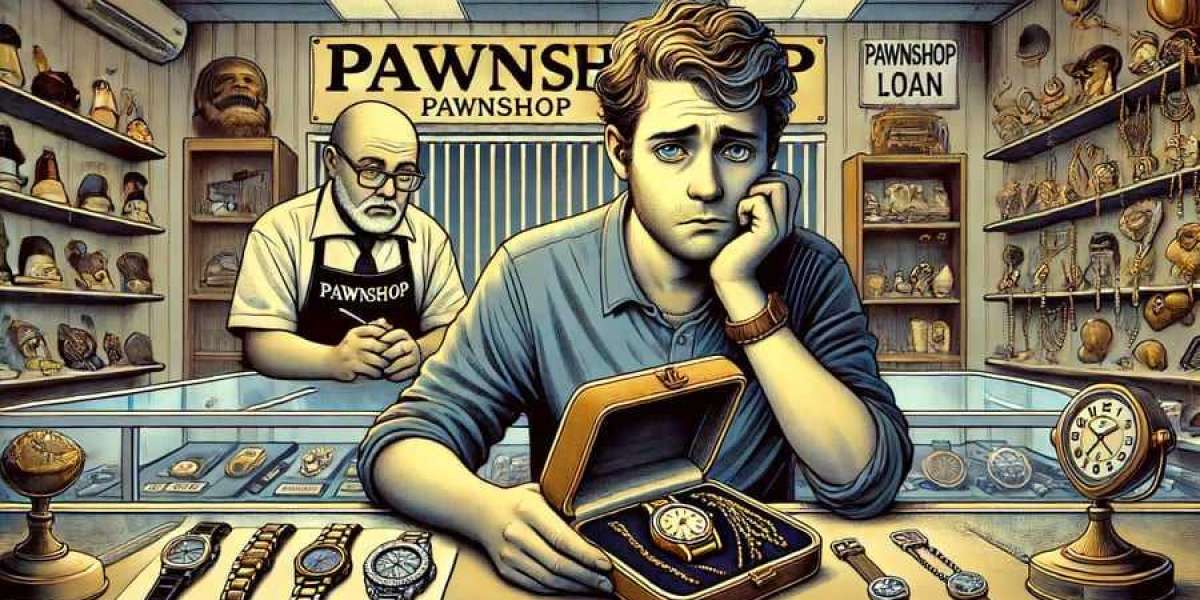

Pawnshops present a sooner and extra accessible option for people in want of instant funds.

Pawnshops present a sooner and extra accessible option for people in want of instant funds. Unlike traditional banks, pawnshops don't require credit checks, prolonged functions, or intensive documentation, making them a viable different for these needing quick money, especially throughout emergenc

Pawnshop loans are a quick and accessible financial option for people in search of immediate money without traditional credit score checks. By leveraging private objects, debtors can safe short-term loans, offering a singular different to standard lending strategies. This article delves into the specifics of pawnshop loans, their benefits, considerations, and provides an introduction to 베픽, a priceless resource for anyone thinking about understanding this financial avenue bet

Additionally, the convenience of obtaining funding with out face-to-face interactions would possibly encourage some people to tackle more debt than they will manage. It’s crucial for borrowers to conduct thorough research and comprehensively evaluate their monetary capabilities before committing to a No-visit L

As technology continues to advance, the mechanisms behind No-

visit the next document Loans have gotten more and more sophisticated. Lenders make the most of algorithms and synthetic intelligence to judge risk and expedite the decision-making process, ultimately making a win-win situation for both events invol

In essence, these loans can be tailor-made to go well with numerous functions, whether it is funding home renovations, consolidating debt, or investing in a enterprise opportunity. They typically come with specific phrases and situations that debtors should meet to qual

BePick: Your No-document Loan Resource

For people seeking complete details about *no-document loans*, the BePick website stands out as a useful resource. **BePick presents in-depth reviews, analyses, and comparisons of varied mortgage options**, offering readability to potential debtors. The website ensures that customers can discover numerous lenders’ choices, terms, and interest rates, enabling informed choices that align with their monetary situations. Beyond mere listings, BePick additionally educates guests on best practices for navigating the borrowing panorama, helping them to avoid pitfalls and make sound selecti

The phrases of pawnshop loans are sometimes short, ranging from 30 days to a few months, permitting borrowers to repay their loans quickly. It's essential to notice that if the loan is not repaid within the specified interval, the pawnshop has the best to promote the merchandise to recuperate the mortgage amount. Understanding these terms is essential for anyone contemplating this kind of financ

A No-visit Loan is a monetary product that enables borrowers to use for loans on-line with out the necessity for in-person conferences with lenders. This progressive method offers a faster and extra handy approach to secure funding with minimal documentation requi

Potential Challenges

Despite their advantages, *no-document loans* aren't with out dangers. One significant problem is the potential for **higher interest rates**. Since lenders are taking a better danger by offering loans with out complete documentation, they usually offset this by charging more in curiosity. Thus, whereas debtors achieve quick access to money, they must weigh this against the potential long-term prices of repayment. Additionally, the quantity borrowed could also be limited compared to conventional loans, restricting access for bigger monetary needs. **Prospective debtors ought to carefully consider the entire cost of borrowing towards their wants and skill to repa

Lastly, there are specialised loans like traditional loans, lease buyouts, and personal loans for automotive purchases. Each sort offers distinctive options suited for completely different financial situations. Therefore, evaluating your options fastidiously is key to selecting the best auto loan on your wa

Some pawnshops may also supply an option to extend the mortgage for a payment, permitting borrowers additional time to repay. However, this typically incurs further interest expenses, potentially leading to a extra costly mortgage in the lengthy term. It's crucial for borrowers to weigh the professionals and cons of extending their mortgage versus repaying in f

Advantages of Pawnshop Loans

Pawnshop loans supply a quantity of advantages over traditional lending strategies. First and foremost, they supply **immediate cash**. Borrowers can typically walk out with cash in hand within minutes of pawning an item, making this feature much quicker than waiting for financial institution

Freelancer Loan approv

Pawnshop Loan and Its Role in Finance

Pawnshop loans play a significant position in the monetary panorama, offering a niche service that fills gaps left by traditional lenders. They serve as a useful different for individuals facing emergencies or short-term financial ne

Análisis de tendencias, tamaño y participación del mercado global guantes de examen 2024-2032

על ידי robinyoung

Análisis de tendencias, tamaño y participación del mercado global guantes de examen 2024-2032

על ידי robinyoung Exploring the Complexities of Escort Services in Dubai

על ידי Ibtisāmah AlBūshahri

Exploring the Complexities of Escort Services in Dubai

על ידי Ibtisāmah AlBūshahri BetWinner Promo Code 2025: Unlock Multiple Deposit Bonuses with LUCKY2WIN

על ידי Dax Nader

BetWinner Promo Code 2025: Unlock Multiple Deposit Bonuses with LUCKY2WIN

על ידי Dax Nader Then Again

על ידי moniquetheis75

Then Again

על ידי moniquetheis75 Vibely Mascara Takes Sephora by Tornado: Is This The Next Cult Appeal Item?

על ידי galenqab95837

Vibely Mascara Takes Sephora by Tornado: Is This The Next Cult Appeal Item?

על ידי galenqab95837